121

HSRC Annual Report 2016/17

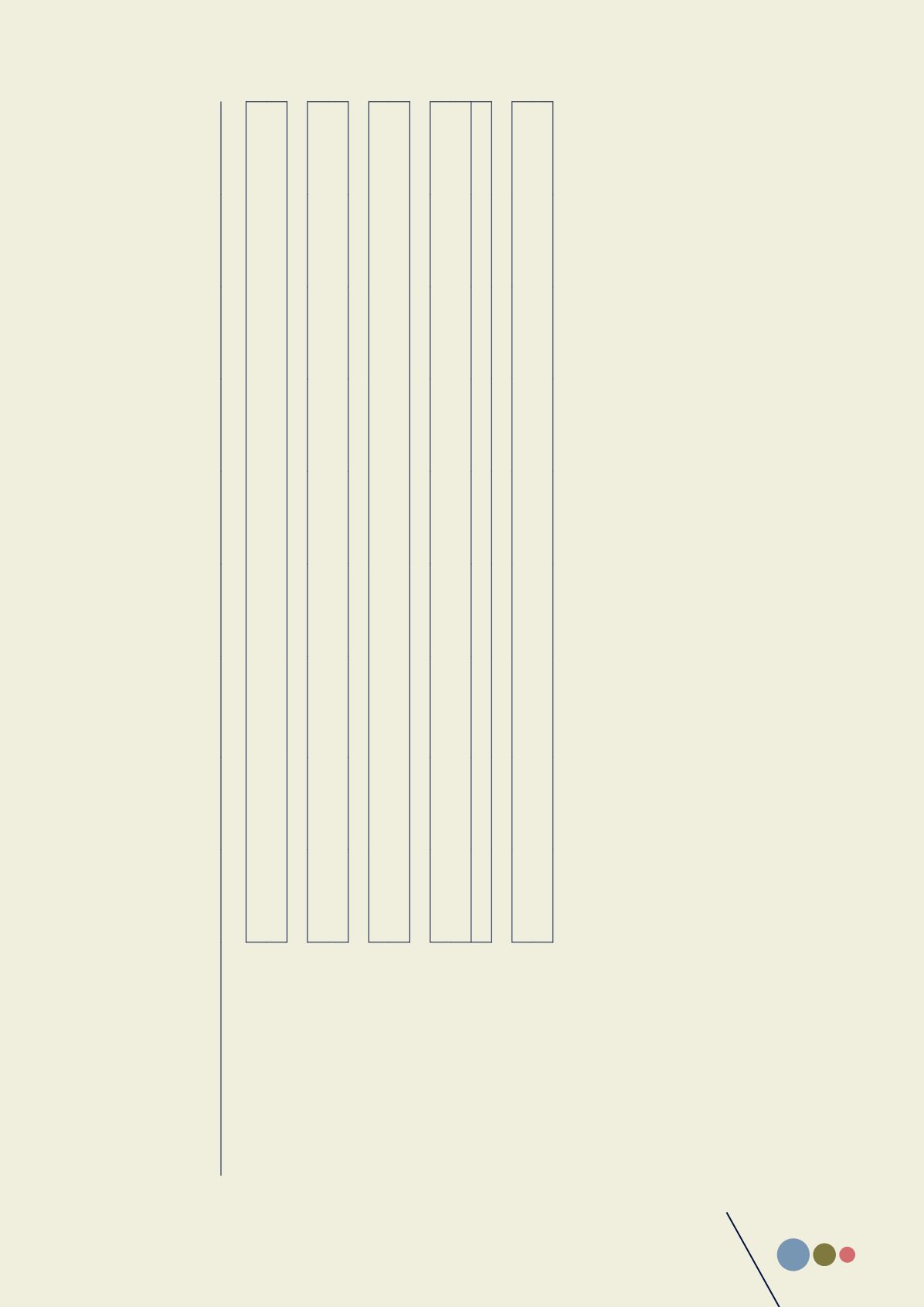

Balance as at 31 March 2016

Reconciliation of carrying value

Total

R ‘000

Land and

buildings

R ‘000

Leasehold

improvements

R ‘000

Artwork

R ‘000

Motor

vehicles

R ‘000

Office

furniture

R ‘000

Equipment

R ‘000

Computer

equipment

R ‘000

Medical

equipment

R ‘000

Opening net carrying amount

207,702

179,942

278

1,676

5,659

8,452

4,288

7,297

110

Gross carrying amount

267,180

196,058

3,759

2,123

7,791

13,172

13,588

28,596

2,093

Accumulated depreciation

(59,478)

(16,116)

(3,481)

(447)

(2,132)

(4,720)

(9,300)

21,299)

(1,983)

Additions and revaluations

22,711

-

18

-

16,702

219

3,046

2,326

400

Revaluation adjustment

3,534

3,412

122

Additions

19,177

18

-

13,290

219

3,046

2,204

400

Assets reclassification

(3,534)

-

-

-

(3,412)

-

-

(122)

-

Cost

(3,534)

-

-

(3,412)

-

(122)

-

Accumulated depreciation

-

-

-

-

-

-

Disposals

(458)

-

-

-

(263)

(19)

(4)

(166)

(6)

Cost of disposal

(2,398)

-

(65)

(538)

(31)

(60)

(1,566)

(138)

Accumulated depreciation of disposal

1,940

-

65

275

12

56

1,400

132

Depreciation

(6,515)

(2,192)

(288)

(109)

(138)

(405)

(855)

(2,484)

(44)

Closing net carrying amount

219,906

177,750

8

1,567

18,548

8,247

6,475

6,851

460

Gross carrying amount

283,959

196,058

3,712

2,123

20,543

13,360

16,574

29,234

2,355

Accumulated depreciation

(64,053)

(18,308)

(3,704)

(556)

(1,995)

(5,113)

(10,099)

(22,383)

(1,895)

Historical cost would have been:

86,274

85,141

1,133

The land is registered as Stand 3242 Pretoria, measuring 7 655 m², Registration division JR, Transvaal and is situated at 134 Pretorius Street, Pretoria. The buildings classification combines land, lifts, telephone

systems, fixtures and buildings and comprises a reception area, offices, parking area, conference centre and a cafeteria. The valuation was conducted on 1 November 2014 by an independent valuer, Mr Mongodi

Pitso of Dijalo Valuation Services Management (Pty) Ltd, using the discounted cash flow (DCF) analysis method. In the DCF analysis the lease income is discounted for the total lease period at a discount rate

deemed appropriate. The total of the net cash flows equates to the net present value of the property. Market related capitalisation rates in the Pretoria CBD range between 9.90% for A-grade properties to 12.40%

for C-grade. A capitalisation rate of 11.50% was applied. Application of the R157 bond rate as per the date of valuation as well as the relevant sector and risk factors resulted in a total discount rate of 16.45%. The

building is not held as security for any obligations.

Artwork belonging to the HSRC was also revalued on 31 March 2015. The valuation was performed by Mr Gerrit Dyman of Absolut Art Gallery by observing similar artwork in the market and the prices such

artwork would cost on the valuation date.