111

HSRC Annual Report 2016/17

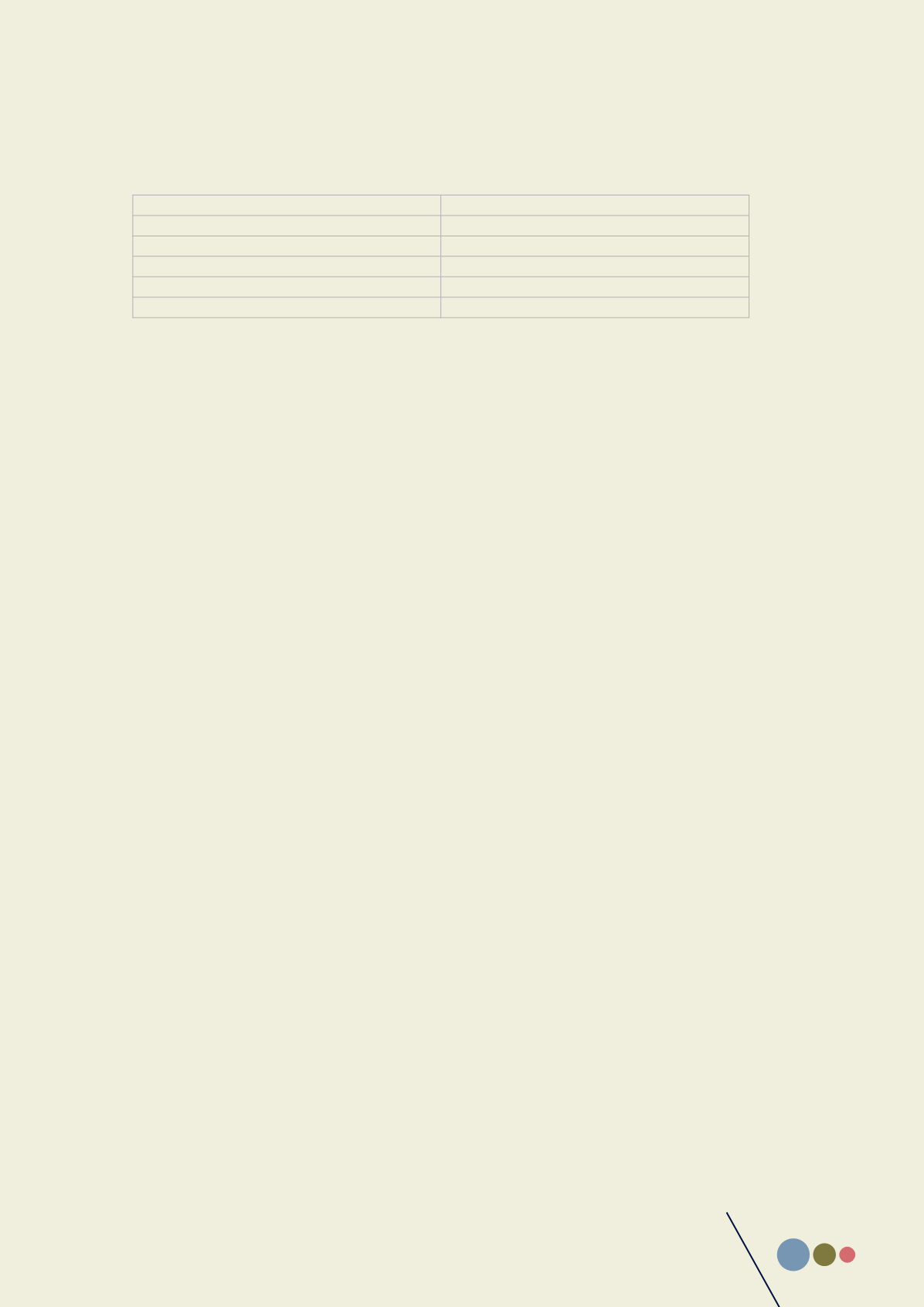

1.6.2.3. Equipment, motor vehicles and artwork

The useful lives of the various categories of equipment have been assessed to be:

Office furniture

22 years

Motor vehicles

5 years

Computer and other equipment

5–22 years

Library books and manuscripts

20 years

Artwork

25 years

Mobile clinics

Estimated kilometres

1.6.2.4. Leasehold assets

Leasehold assets are depreciated over the period of the rental agreement.

1.6.2.5. Donor funded assets

All assets that were bought with donor funds are depreciated over the shorter of the asset’s useful life or project duration.

1.6.3.

De-recognition of assets

An item of property, plant and equipment is de-recognised upon disposal or when no future economic benefits are

expected from its use or disposal. Any gain or loss arising on de-recognition of the asset (calculated as the difference

between the net disposal proceeds and the carrying amount of the asset) is included in the Statement of Financial

Performance in the year the asset is derecognised.

1.6.4. Key estimates and assumptions applied by management

1.6.4.1. Property, plant and equipment and intangible assets

Property, plant and equipment and intangible assets are depreciated over their useful lives, taking into account residual

values, where appropriate. The actual lives of the assets and residual values are assessed annually andmay vary depending

on a number of factors. In re-assessing asset lives, factors such as technological innovation andmaintenance programmes

are taken into account. Residual value assessments consider issues such as future market conditions, the remaining life

of the asset and projected disposal values. HSRC reassessed assets useful lives as at 31 March 2017, with depreciation

decreasing by R1.1 million annually in future financial years.

1.6.4.2. Revaluation of property, plant and equipment

HSRCmeasures its land and buildings at revalued amounts with changes in fair value being recognised in the Statement

of Changes in Net Assets. The entity engaged independent valuation specialists to determine fair value on 1 November

2014, thereby impacting depreciation for the 2016/17 financial year. The key assumptions used to determine the fair

value of the land and buildings are further explained in Note 6.1 and 6.2.

1.7. Intangible assets

1.7.1. Initial recognition

Intangible assets that meet the recognition criteria are stated in the Statement of Financial Position at amortised cost,

being the initial cost price less any accumulated amortisation and impairment losses.

An intangible asset is recognised when:

•

It is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and

•

The cost of the asset can be measured reliably.

Intangible assets are initially recognised at cost. Expenditure on research (or on the research phase of an internal project)

is recognised as an expense when it is incurred.