128

HSRC Annual Report 2016/17

PART E: Annual Financial Statements

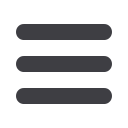

12.4 Particulars of the liabilities

The membership details of the members in active employment and who are entitled to a subsidy after continuation

as at reporting date:

Number of members

Average past service – years

2017

2016

2017

2016

Male members (Age band: 45–49)

1

1

26.2

25.2

Total/weighted average

1

1

26.2

25.2

The average age of these members was 50 years as at 31 March 2017, compared to 49 years in respect of the active

members as at 31 March 2016. Average monthly employer contributions 2017: R2,192.50 (2016: R4,026.00)

Details of the continuation members (being members no longer employed by the HSRC) as at reporting date:

Number of

members

Average premium

principal member

per month – R’s

Average weighted

age – years

2017

2016

2017

2016

2017

2016

Total/weighted average

70

74

529

518

81.7

80.7

The table below summarises the profile of the continuation pensioners subsided by the HSRC as at 31 March 2017:

Age band: 50–54

0

Age band: 75–79

12

Age band: 55–59

1

Age band: 80–84

31

Age band: 60–64

1

Age band: 85–89

14

Age band: 65–69

1

>90

7

Age band: 70–74

6

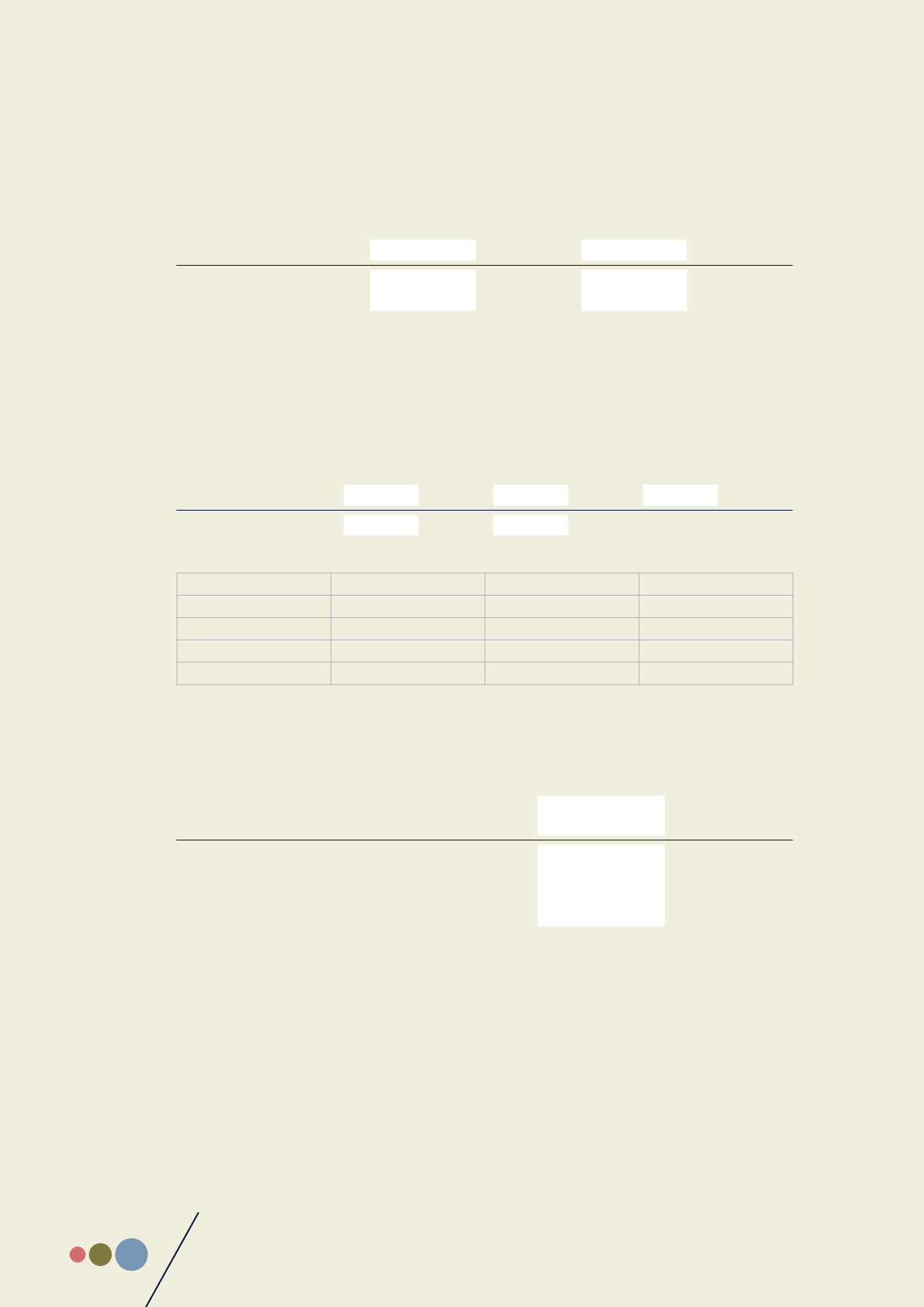

12.5 Key financial assumptions

12.5.1 Summary assumptions

The economic assumptions for the 31 March 2017 valuation are shown in the table below, and compared to those used

as at the previous valuation date.

% per annum

2017

% per annum

2016

Discount rate

8.69

9.20

Consumer Price Inflation

5.85

6.78

Healthcare cost inflation rate – in service employees

7.35

8.28

Net discount rate

1.25

0.85

12.5.1.1 Discount rate

GRAP 25 requires that the discount rate used in the valuation be determined by reference tomarket yields on government

bonds as at the reporting date. The currency and term of the government bonds shall be consistent with the currency

and estimated term of the post-employment benefit obligations.

At the previous valuation date, 31 March 2016, the duration of the liabilities was 7.19 years. At this duration, the discount

rate determined by using the Bond Exchange Zero Coupon Yield Curve as at 31 March 2017 is 8.69% per annum.

12.5.1.2 Healthcare cost inflation

A healthcare cost inflation rate of 7.35% was assumed. This is 1.5% in excess of the expected inflation over the expected

term of the liability, at 5,85%. However, it is the relative levels of the discount rate and healthcare inflation to one another

that are important, rather than the nominal values. We have thus assumed a net discount factor of 1.25% per annum.