134

HSRC Annual Report 2016/17

PART E: Annual Financial Statements

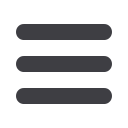

22. Reconciliation of net cash flows from operating activities to surplus

2017

R ‘000

2016

R ‘000

(Deficit)/Surplus for the year

(19,643)

31,545

Adjustment for:

Depreciation and amortisation

11,253

6,996

Bad debts written off

525

1,179

Increase in provisions relating to employee cost

2,457

1,366

Losses on disposal of property, plant and equipment

1,207

1,012

Net foreign exchange loss/(gain)

44

(784)

Other adjustments

(608)

824

Items disclosed separately

Receipts of sales of assets

(10)

(164)

Operating (deficit)/surplus before working capital changes:

(4,775)

41,974

(Increase)/decrease in inventories

(631)

2,657

(Increase)/decrease in other receivables

(7,927)

995

Increase in VAT receivable

(1,658)

(3,280)

Decrease in post retirement medical benefit

(182)

(814)

(Increase)/decrease in trade receivables

(4,829)

610

(Increase)/decrease in prepayments

(3,775)

3,735

Increase in income received in advance

1,773

85

(Decrease)/increase in trade payables

(2,125)

5,476

Movement in lease accruals

1,350

(154)

Movement in lease commitments

85

(424)

Cash generated by operations

(22,694)

50,860

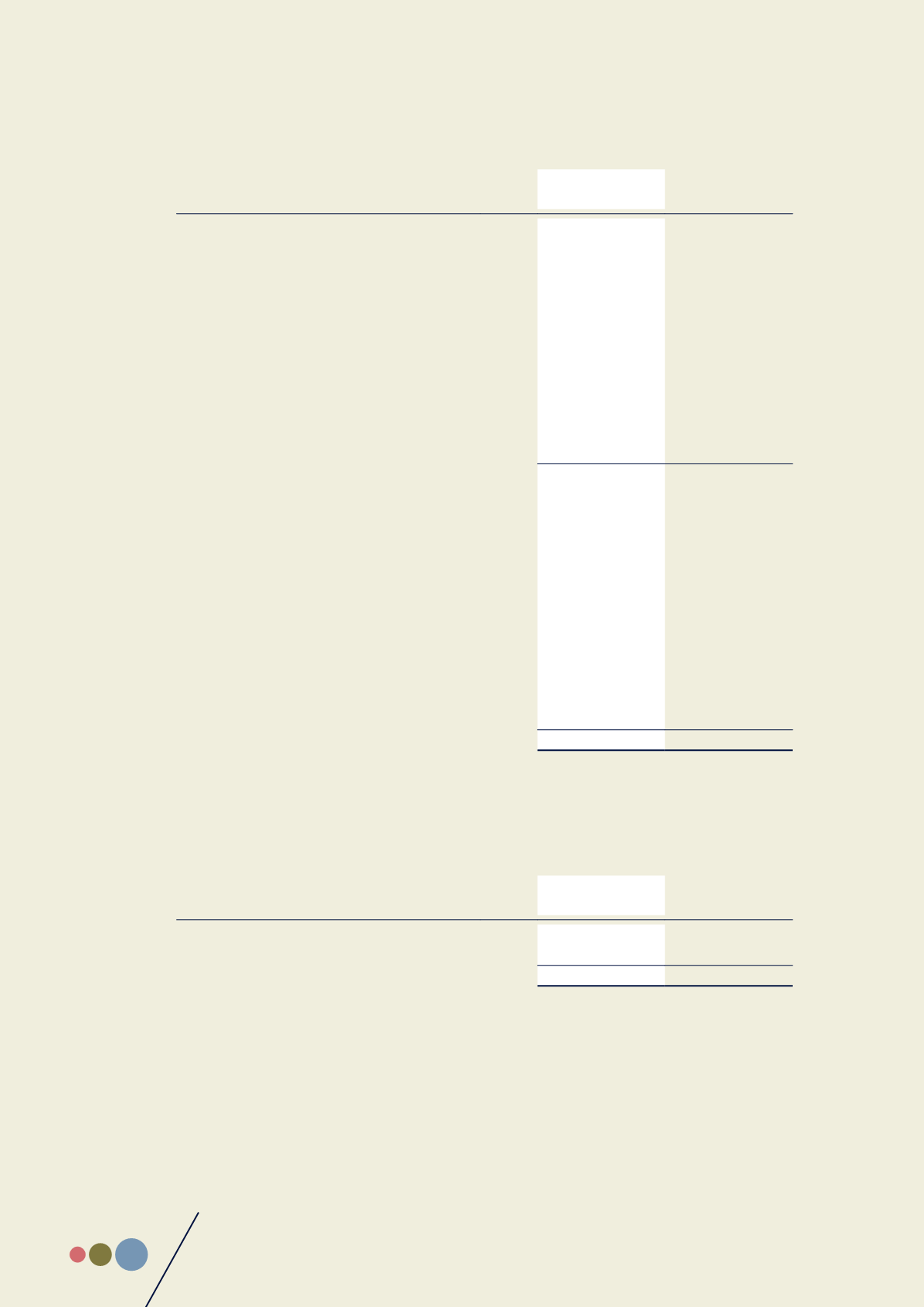

23. Contingent assets and liabilities

Pending claims

All the claims are being contested based on legal advice. The financial details of these claims are as follows:

2017

R ‘000

2016

R ‘000

Counter claim made by the HSRC (Possible contingent asset)

2,950

2,950

Claim against HSRC (Possible contingent liability)

(8,048)

(1,280)

Net claims

(5,098)

1,670

Case 1

The HSRC terminated a service provider contract as a result of non-delivery, and the service provider, Underhill Investment

Holdings, subsequently issued summons for the amount of R1,176,243.00. The HSRC filed a counterclaim to the value

of R2,949,914.69 claiming damages which were incurred due to the forced termination of the contract. This case is still

pending and may likely be settled.