139

HSRC Annual Report 2016/17

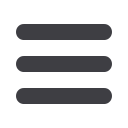

26. Prior period errors – adjustments

The following prior period errors have been identified and the specific effect on Financial Statements have been set

out in Note 26.1. These errors have been corrected and comparatives restated accordingly and rounded off (R’000). The

effect on previously reported financial statements is also indicated:

To enhance presentation and provide more detailed information to the users, additional line items have been reclassified

or disclosed separately. Such adjustments had no financial impact on the surplus of the HSRC and as such were not

disclosed separately in this note. Items, disclosed below, are those that had an impact on the results previously reported.

These prior period errors have no tax effect as the HSRC is exempt in terms of the Income Tax Act.

26.1 Misstatement of revenue and expenditure items

Description

Key

Adjustment R’000

Increase administrative expenses

(i)

341

Decrease in income received in advance

(ii)

126

Increase in other operating expenses

(i)

185

Increase in research cost

(i)

230

Increase in research revenue (from exchange transactions)

(ii)

(125)

Increase in trade and other payables

(i)

(757)

Increase in depreciation

(iii)

38

Increase in accumulated depreciation

(iii)

(38)

(i) An adjustment on depreciation related to artwork that had not been depreciated correctly in the 2015/16 financial

year.

(ii) Adjustment as a result of additional expenses received in the 2016/17 pertaining to the 2015/16 financial year and

had not been accrued for as at 31 March 2016.

(iii) Adjustments noted in (i) above included entries on research projects and resulted in adjustments in external income

and income received in advance.

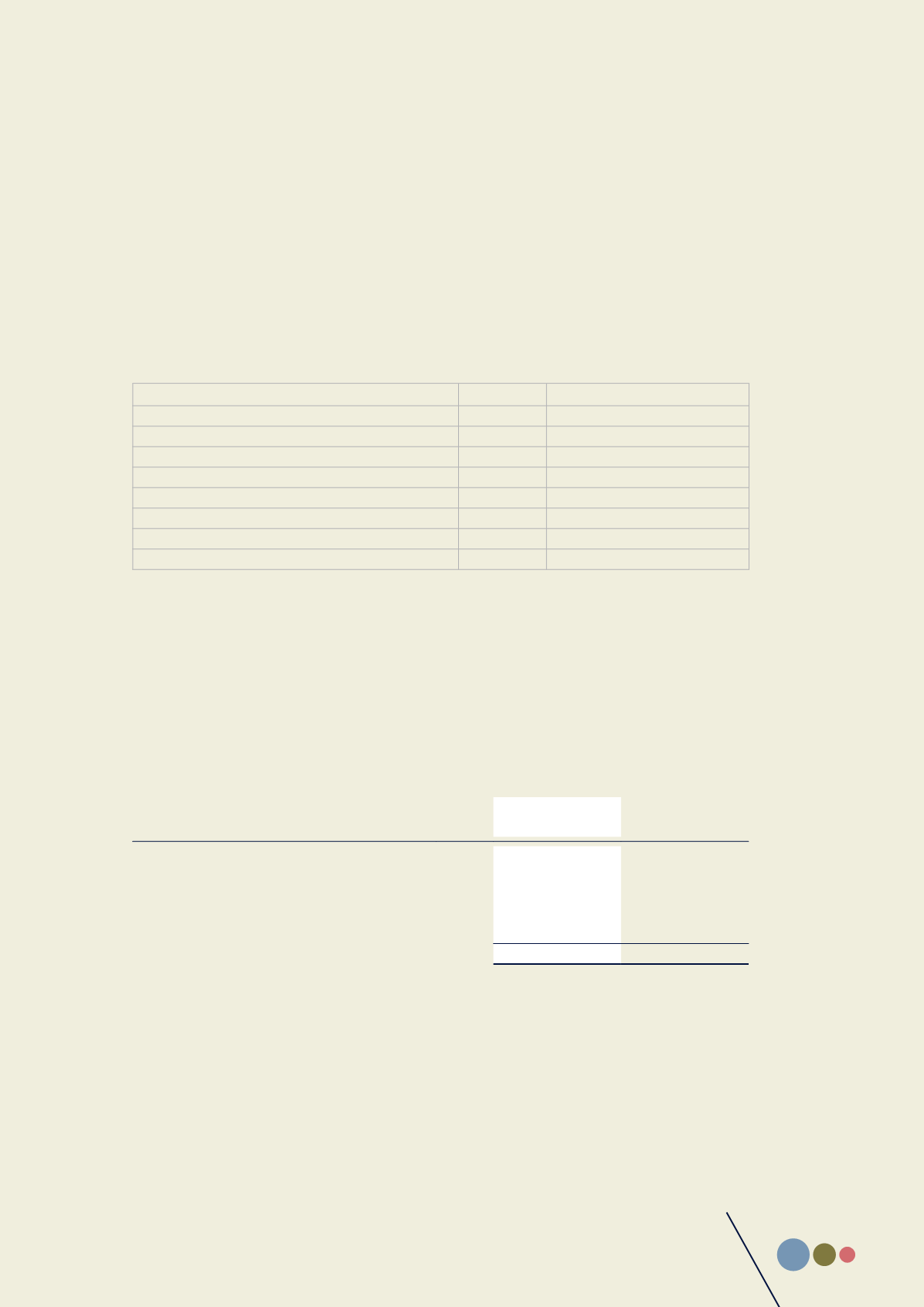

27. Irregular expenditure

2017

R ‘000

2016

R ‘000

Opening balance

3,968

-

Irregular expenditure – current year with goods received at

reasonable market rates

6,465

3,968

Irregular expenditure – current year with goods not received

-

-

Irregular expenditure – condoned

(3,968)

-

Irregular expenditure awaiting condonement

6,465

3,968

Analysis of irregular expenditure

A significant portion of the irregular expenditure recorded relates to the refurbishment of our Cape Town offices,

where a certain portion of additional construction costs were incurred without following the normal SCM processes.

This was largely as a result of unanticipated timelines associated with the entire relocation project. An independent

investigation was commissioned to identify internal defficiencies and lessons for future reference. The main project

manager unfortunately left the HSRC after concluding a mutual termination agreement. Although the expenses were

disclosed as irregular due to a purchase order not being issued before the service provider installed the changes, the

independent review and the HSRC’s Audit and Risk Committee verified that it was indeed value for money and the

structures installed were necessary for the HSRC staff to occupy the building. Other instances of irregular expenditure

relate to emergency procurement necessitated by unanticipated project timelines which resulted in the impracticability

of competitive sourcing of service providers.