141

HSRC Annual Report 2016/17

29.5 Administrative expenses

Administration costs mainly include audit fees, subscriptions and manuscripts, insurance related costs, printing and

photocopying expenses as well as postal and delivery costs. Spending for the financial year was within budgeted

amounts with 3% unutilised being channelled to core research activities.

29.6 Research cost

Research costs incurred exceeded budgeted amount by 6%. When comparing research costs to research revenue the

difference is 15% as opposed to breaking-even. This is due to the utilisation of the prior year surplus to further other

unfunded research projects which were undertaken once the surplus retention approval was received from National

Treasury.

29.7 Staff cost

Staff costs spending exceeded the budgeted amount by 1%, being an amount of R2 million. This was largely as a result

of termination benefits paid to two former Executives of the HSRC amounting to R3.3 million. One instance was a CCMA

case where the employee was awarded a pay-out, while the other was a mutual termination arrangement effected on

15 March 2017.

29.8 Other operating expenses

Expenditure was below the budgeted amount for the financial year due to stringent cost containment measures which

continue to be implemented with an aim of ensuring that the organisation remains sustainable in the long-term,

channelling more funding to core research activities.

29.9 Depreciation, amortisation and impairment expense

Depreciation expenses exceeded budgeted amounts due to research projects undertaken in the year with extensive

assets capitalisation. Such assets are depreciated at the lower of their useful lives or project duration, hence the increase

in the depreciation expenses recorded for the financial year.

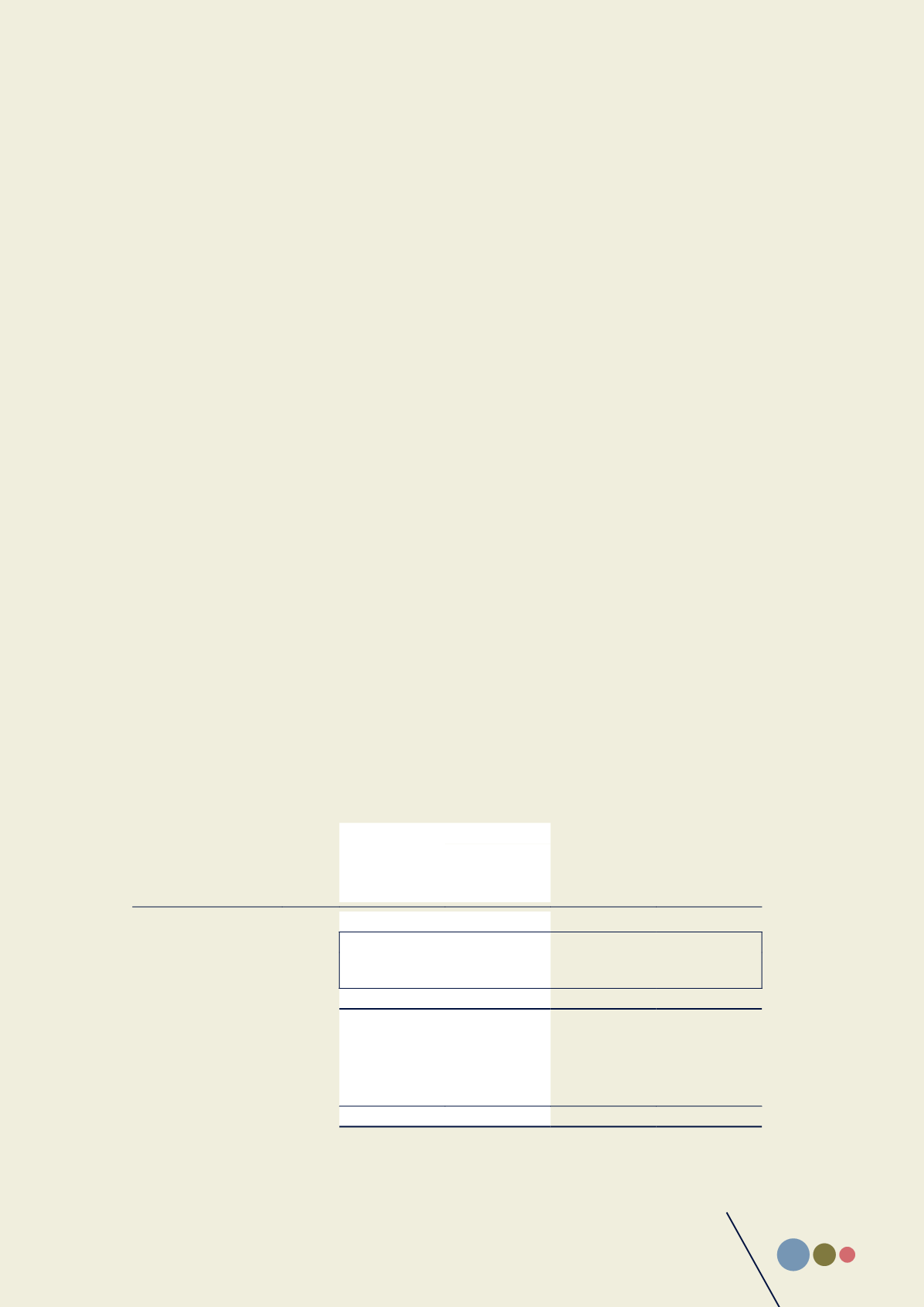

30. Financial instruments

30.1

Financial instruments consist of receivables, payables, finance leases and cash and cash equivalents. In the case of all

financial instruments, the carrying value approximates the fair value based on the discounted cash flowmethod which

was used to estimate the fair value. As at 31 March 2017 the carrying amounts and fair values for the financial assets or

liabilities were as follows:

Note(s)

2017

2016

Carrying

amount

R’000

Fair value

R’000

Carrying

amount

R’000

Fair value

R’000

Financial assets

Cash and cash equivalents

1

61,307

61,307

111,148

111,148

Trade and other

receivables

2

43,727

43,727

30,388

30,388

105,034

105,034

141,535

141,535

Financial liabilities

Measured at amortised

cost

Trade and other payables

8

29,786

29,786

31,911

31,911

Finance lease liability

10

-

-

-

-

29,786

29,786

31,911

31,911