142

HSRC Annual Report 2016/17

PART E: Annual Financial Statements

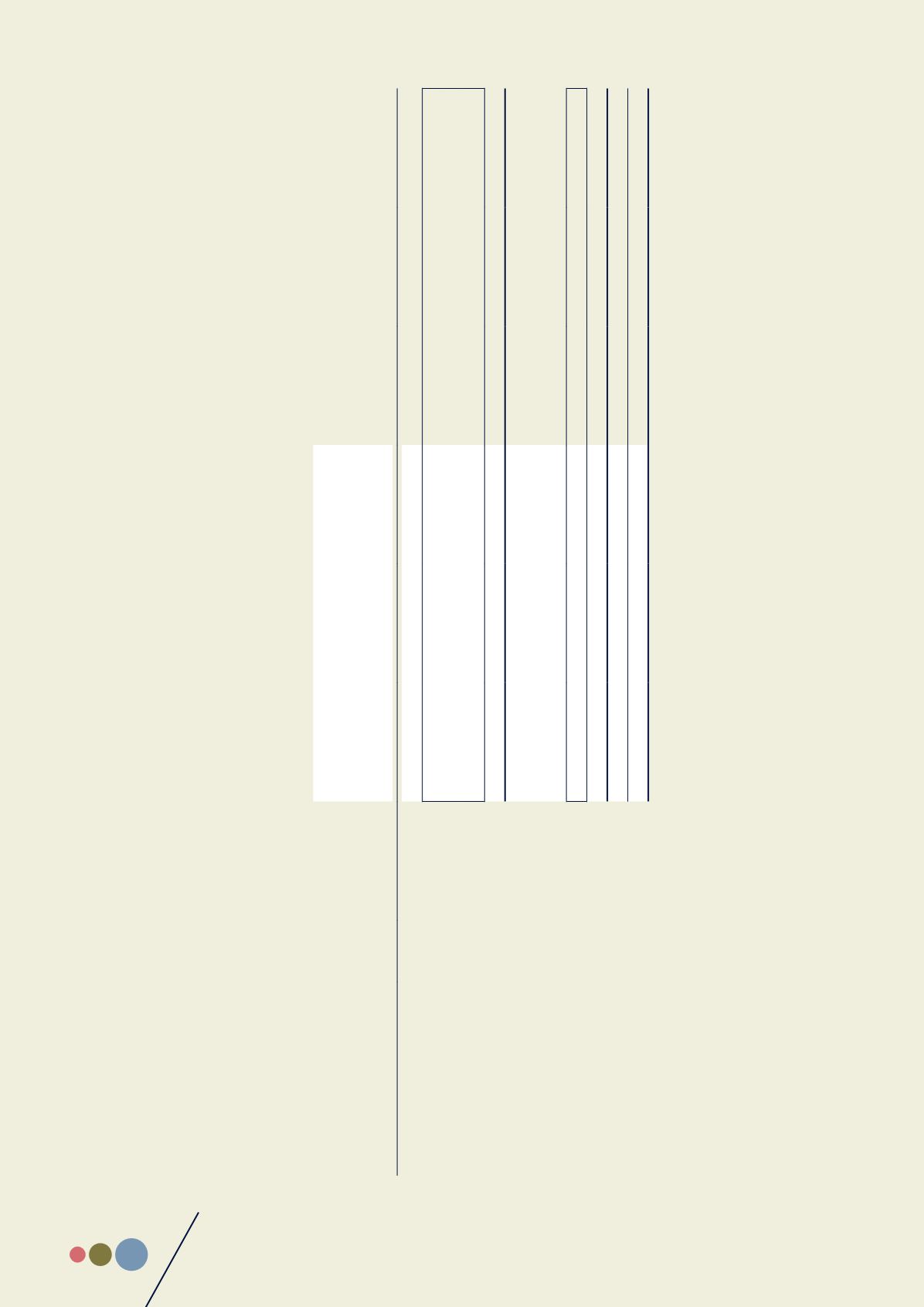

In the course of the HSRC operations, the entity it is exposed to interest rate, credit, liquidity and market risk. The HSRC has developed a comprehensive risk strategy in order to monitor and control these risks.

The risk management process relating to each of these risks is discussed and disclosed under the headings below:

Interest rate risk

The HSRC manages its interest rate risk by fixing rates on surplus cash funds using short- to medium-term fixed deposits. The HSRC’s exposure to interest rate risk and the effective rates applying on the different

classes of financial instruments is as follows:

Note(s)

Effective

interest rate

(fluctuating)

2017

2016

Less than 12

months

R’000

1 – 5 years

R’000

Total

R’000

Less than 12

months

R’000

1 – 5 years

R’000

Total

R’000

Financial assets

Current accounts

1

3.00%

11,580

-

11,580

17,063

-

17,063

Short-term investments accounts

1

5-6.5%

49,727

-

49,727

94,084

-

94,084

Trade and other receivables

2

0.00%

43,727

-

43,727

30,388

-

30,388

Total financial assets

105,034

-

105,034

141,535

-

141,535

Financial liabilities

Measured at amortised cost

Trade and other payables

8

0.00%

29,786

-

29,786

31,911

-

31,911

Total financial liabilities

29,786

-

29,786

31,911

-

31,911

Net financial assets/(liabilities)

75,249

-

75,249

109,624

109,624

30.3 Credit risk

Financial assets, which potentially subject the HSRC to the risk of non-performance by counterparties and thereby subject to credit concentrations of credit risk, consist mainly of cash and cash equivalents and

trade receivables from non-exchange transfers. The entity only deposits cash with major banks with high quality credit standing and limits exposure to any one counterparty. Trade receivables are presented net

of the allowance for doubtful debts. The HSRC manages/limits its treasury counterparty exposure by only dealing with well-established financial institutions approved by National Treasury through the approval

of their investment policy in terms of Treasury Regulations. In addition, the credit risk exposure emanating from trade receivables is not considered significant as trade is largely conducted with reputable research

partners who have had and maintained good relationships with the HSRC in the past. Thus HSRC’s significant concentration risk is with its research partners. The analysis of ageing of receivables that are 30 days

and older is as follows: