Innovation and firm performance in South African manufacturing and services businesses

South Africa needs skilled labour for technological innovation in the manufacturing sector. The shortage of engineering practitioners as well as artisans and technicians with tertiary education underscores the need for investment in post-school education and training, including technical vocational education and training colleges, with a focus on the science, engineering and technology fields. Photo: Alexander Little, Freepik

Ever since the German political economist Joseph Schumpeter highlighted the importance of innovation in economic development in 1934, innovation has been widely regarded as the key factor influencing firm performance. In fact, many firms seek ways to achieve greater profits and productivity through different types of innovation. As global market competition and constantly changing technologies continue to erode the value-add of existing products and services, firms need to find new ways to keep up with the market. By Amy Kahn and Atoko Kasongo

To remain competitive, firms must treat innovation as a vital component of their corporate strategy as they seek to develop more productive manufacturing processes, perform better in the market and earn a positive reputation among customers.

South Africa lags behind other emerging markets in terms of technological progress and there is insufficient innovation in private firms. Increased competition from other countries, including those in East and South Asia, means that we must invest more in innovation to stop falling further behind. To design effective instruments to promote innovation, policymakers need to better understand what drives innovation in South African firms at the sectoral level. There is also a need to understand how innovation can improve firms’ productivity and competitiveness in the world economy, in turn benefiting the South African economy and society at large.

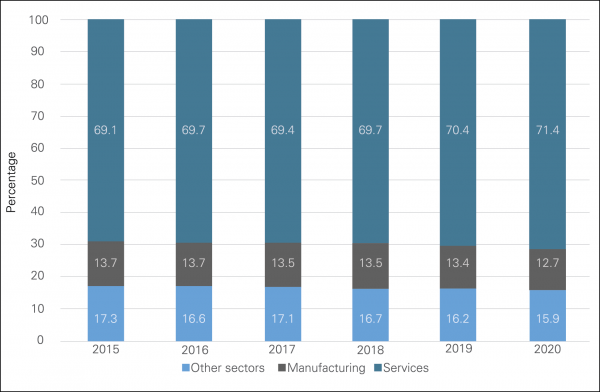

Figure 1: Sectoral contribution as a share of GDP

Source: Stats SA (2020) Statistical Release

Note: Other sectors include agriculture, fishing, and forestry; mining; electricity, gas and water; and construction. The services sector includes trade, catering and accommodation services; transport and storage; communication; finance and real estate; business services; general government services; and personal services.

Data from a Statistics South Africa (Stats SA) report for 2020 show that the manufacturing and services sectors emerged as the major contributors to gross domestic product (GDP) in South Africa. Both sectors are regarded as highly important for economic growth and employment. In South Africa, manufacturing is particularly important in creating jobs for the unskilled working population. In addition, manufacturing can generate an increased demand for services inputs, thus helping to grow the services sector. However, while manufacturing accounts for, on average, 13% of GDP, it has declined over the last two decades, and faster than in South Africa’s BRICS counterparts, according to a 2018 paper by Carl Friedrich Kreuser and Carol Newman. By contrast, the services sector on average contributes 65% of GDP, a significant increase from nearly 60% in 2000. In addition to its significant contribution to GDP, the services sector accounts for 63% of employment and 74% of capital formation in South Africa, according to Stats SA.

Although it makes a lower contribution to GDP in comparison with services, manufacturing accounts for most of the R&D in the South African economy. At the same time, manufacturing firms’ spend on R&D in South Africa is low by international standards.

Given the significance of these two sectors, it is imperative to investigate the role of innovation in a bid to boost economic growth. This is emphasised in the White Paper on Science, Technology, and Innovation 2019, which points to innovation as a means to modernise and grow South Africa’s manufacturing sector. Research using Business Innovation Survey (BIS) data collected by the HSRC’s Centre for Science, Technology, and Innovation Indicators (CeSTII) highlights how innovation can be promoted in manufacturing and services firms.

Measuring innovation and CeSTII’s Business Innovation Survey

Innovation is a difficult concept to measure. The Oslo Manual, first published by the OECD in 1992, aims to formalise and standardise the measurement of innovation, as well as allow for international comparability of data between countries. The manual provides a set of guidelines to collect and interpret data on business innovation and has been adopted by innovation surveys in over 80 countries, including emerging economies. The South African BIS is one example and has been conducted by CeSTII since 2005 on behalf of the Department for Science and Innovation (DSI), formerly the Department of Science and Technology.

The latest edition of the Oslo Manual, published in 2018, defines ‘innovation’ as ‘a new or improved product or process (or combination thereof) that differs significantly from the unit’s previous products or processes and that has been made available to potential users (product) or brought into use by the unit (process).’ A product innovation, which is categorised as a technological innovation, includes new or improved goods or services, such as improvements in technical specifications, components and materials; user-friendliness; or other functional characteristics. A process innovation is the implementation of a new or significantly improved production or delivery method and includes marketing and organisational changes, which are considered non-technological innovations. A marketing innovation can include new packaging, product promotion and pricing, while an organisational innovation can include new business practices or workplace organisation.

Recent research using CeSTII’s BIS data investigated the role of innovation in stimulating productivity in South African firms in the manufacturing and services sectors. Both sectors contribute significantly to the economy and therefore deserve particular attention when researching innovation and productivity in South Africa’s business sector.

The research on the manufacturing sector highlights some important policy issues. For example, the data show that public financial support for innovation can help to stimulate a firm’s investment in innovation. The results of this research can in turn guide policymaking. For example, the DSI could consider expanding the suite of public financial instruments, such as incentive grants, tax incentives or new kinds of subsidies, to enhance innovation efforts to support manufacturing firms’ increased productivity.

The research also investigates the importance of skilled labour as an input into technological innovation in the manufacturing sector. This is particularly relevant in the South African labour market where there is a big shortage of engineering practitioners as well as artisans and technicians with tertiary education. This underscores the need for investment in post-school education and training, including technical vocational education and training colleges, with a focus on the science, engineering and technology fields. We also need strategies to retain highly skilled workers in the country.

The services-sector investigation shows that both technological (product and process) innovation and non-technological (marketing and organisational) innovation improve productivity in firms. However, non-technological innovation has a larger impact than technological innovation. Policymakers in the relevant departments (DSI; Department of Trade, Industry and Competition; and Department of Higher Education and Training) should design instruments that take this distinction into account. In addition, the results lend support to the use of market sources of information. As such, demand-side intervention such as the promotion of public procurement contracts are vital to boosting innovation in services firms.

In conclusion, the importance of innovation to firm performance and economic growth at large cannot be overemphasised. Further innovation research at the sectoral level is important to develop targeted policies to support firms and encourage innovation if South Africa is to meet its developmental goals.

Authors: Dr Amy Kahn, a research specialist, and Dr Atoko Kasongo, a statistician, at the HSRC’s Centre for Science, Technology and Innovation Indictors (CeSTII)