R&D in South African manufacturing: A sector in deep crisis?

In the manufacturing sector, South African firms such as Sasol have led the way by investing R&D in coal-to-liquid fuel technology and gas-to-liquids research. Photo: Sasol, Brand South Africa

Globally, the manufacturing sector is changing as the use of artificial intelligence, robotics and advanced technology grows at a rapid rate. To compete, companies must adapt and continually engage in research and innovation. Companies in developing countries like South Africa face a growing crisis if they do not keep up. By Luthando Zondi and Kgabo Ramoroka

South African companies in the manufacturing sector are confronted with declining productivity and outdated infrastructure, while stiff competition is mounting from companies in newly industrialised economies like China. As a result, sub-sectors within South Africa’s manufacturing sector have shrunk over the years.

Research by Lawrence Edwards and Rhys Jenkins (2015) shows that in 2010, South African manufacturing was 5% lower than it would have been had Chinese imports not been available on the South African market. More recently, Statistics SA recorded a 3.5% decline in manufacturing production from 2019 to 2020. In a recent paper, Deepak Nayyar writes that industrialisation has been the driver of economic growth and structural transformation in a group of Asian countries. The manufacturing sector provides high levels of employment, and its deterioration worsens developmental challenges such as unemployment. This has prompted at least a couple of questions: Is South Africa’s manufacturing sector in a deep crisis? And what innovation capability exists in this sector, given the widely accepted notion that experimental research and development (R&D) plays a significant role in generating innovations, growth, and productivity in manufacturing industries?

In a world rapidly becoming more technologically advanced, science, technology, and innovation (STI) must be viewed in the context of sustainable development. STI can play a fundamental role in achieving the Sustainable Development Goals, specifically goal 9: to promote inclusive and sustainable industrialisation and foster innovation. STI is considered a primary driver of economic growth and job creation and supports the general socioeconomic reform envisaged by South Africa’s National Development Plan 2030. According to South Africa’s White Paper on Science, Technology, and Innovation 2019, STI can also help to modernise potentially high-impact sectors such as agriculture. At the same time, South Africa’s innovation policy environment faces several challenges, including the exclusion of small-, micro-, and medium enterprises as well as slow growth in the local development of technological innovations. Amid these challenges, the government is committed to increased levels of R&D investment in the economy, aiming to reach the target of 1.5% of gross domestic product in the next decade.

R&D increases knowledge and technology capabilities, enabling a country to gain a comparative advantage over other economies. R&D and technology have enhanced the competitiveness of BRICS countries such as China and India: China has moved up the technology ladder, particularly in the defence sector and robotics, and India is competitive in information technology, writes Nayyar.

Looking at other activities that typify innovation, manufacturing’s largest expense in South Africa is the acquisition of machinery instead of R&D, according to the HSRC’s Business Innovation Survey 2014–2016. Such innovation activity has a negative effect on employment when workers are replaced by assembly-line machinery, for example. Furthermore, firms often import technology that is used for production without the accompanying skills transfer that would ultimately benefit domestic businesses. Equally, R&D done by small and medium enterprises is important for generating knowledge and capabilities, since multinationals tend to have very little effect in South Africa in the transfer of technological capabilities, according to this 2015 paper by Nazeem Mustapha and Pedro Mendi.

To sum up, investment in R&D is vital for businesses to generate innovative products of high novelty, manufacturing processes and materials that create new competitive opportunities and allow for economies of scale.

Private-sector R&D spend in manufacturing

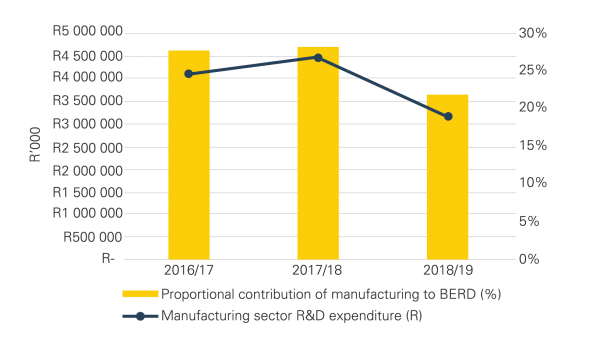

South Africa’s manufacturing sector is the second-largest contributor to business expenditure on R&D, after the financial intermediation, real estate, and business services industries, according to the SA National Research and Experimental Development Statistical Report 2018/19. In the private sector, manufacturing firms have developed R&D capacity for different sectors of products, including food processing, meal refinery and others. Against the strategic necessity of investment to propel innovation, expenditure on R&D declined in the period 2016/17 to 2018/19 from 27.8% (R4.108 billion) in 2016/17 to 21.9% (R3.166 billion) in 2018/19 (Figure 1).

Figure 1:Business enterprise expenditure on R&D (BERD) in the manufacturing sector (2016/17 to 2018/19)

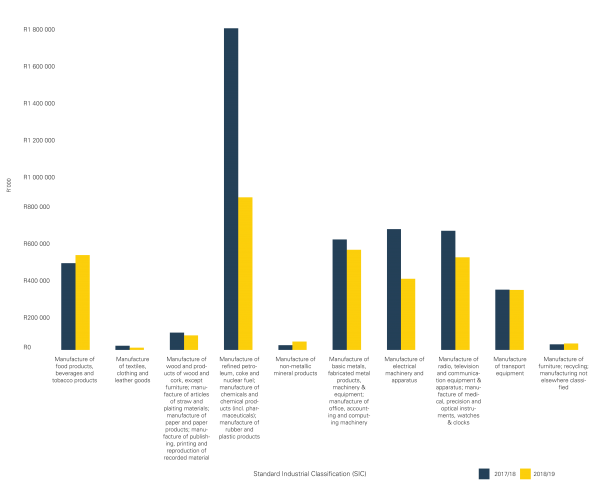

R&D spend declining in some industries

A closer analysis shows that several industries have reduced their expenditure in R&D (Figure 2). Manufacturers of refined petroleum and chemical products – Standard Industrial Classification (SIC) 33, which also includes pharmaceuticals – had the largest share of R&D spend in the manufacturing sector. In 2018/19, their R&D expenditure declined significantly, from R1.692 billion (10.7%) to R802 million (5.6%). Within this sector, South African firms such as Sasol have led the way by investing R&D in coal-to-liquid fuel technology and gas-to-liquids research. The decline is concerning as this division is the largest contributor to overall R&D expenditure in the manufacturing sector. By contrast, R&D expenditure by the manufacturers of food products, beverages, and tobacco products (SIC 30) increased from R455 million to R498 million.

Figure 2: Business enterprise expenditure on R&D (BERD) by manufacturing divisions (R million), 2017/18 to 2018/19

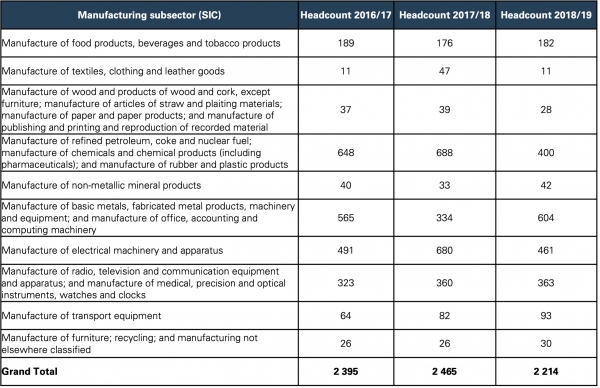

R&D employees in manufacturing companies

Human resource capacity forms a critical part of a firm’s research and development activity. This is supported by Deloitte’s Manufacturing Competitiveness Report, which found that skilled human capital (which includes its availability and productivity) drives industrial competitiveness and is essential to enhancing the competitiveness of the domestic manufacturing sector. As presented in Table 1 below, in the past three years, we observe a decline in the number of researchers, notably by the chemicals division (288) and electrical machinery division (219), while basic metals employed more researchers (270) during the same period.

Table 1: Researcher headcount by Standard Industrial Classification (SIC) in the manufacturing sector

Source: National Survey of Research and Experimental Development, 2016/17 to 2018/19

Note: Industry classification is based on Stats SA’s five-digit SIC codes, which classify businesses according to economic activities.

Conclusion

R&D investment plays a crucial role in economic growth and enhances knowledge intensity and technology capabilities for national economies. In the manufacturing sector, however, R&D expenditure dropped from 27.8% in 2016/17 to 21.9% in 2018/19. The near halving of spending by the chemicals sector from 10.7% (2017/18) to 5.6% (2018/19) had severe effects on the overall sectoral performance. Other subsectors need to increase investment in manufacturing R&D activity to gain a competitive advantage globally.

The role of the government has been crucial to the success of industrialisation in several countries in East Asia, including South Korea, Taiwan, and Singapore, according to Nayyar. Similarly, the South African government must play a critical role in improving R&D activity in manufacturing and other sectors. Policy should concentrate on all manufacturing industries and support traditional manufacturing firms in using R&D to close the technological gap between South Africa and industrialised countries. Our findings indicate that R&D in the manufacturing sector is not entirely in crisis, but all firms must play their part in enhancing research and innovation at large.

Authors: Luthando Zondi, a junior researcher, and Dr Kgabo Ramoroka, a research specialist, at the HSRC’s Centre for Science, Technology, and Innovation Indicators