Rethinking growth-unemployment puzzles in the COVID-19 recession: Contextualising SA's macroeconomic policy options

The total value of goods and services produced inside South Africa’s borders fell steeply in the last two quarters of 2019, resulting in a sharp rise in unemployment. The government’s latest macroeconomic reforms to lift the country out of the 2019 economic downturn and create sustainable jobs are unlikely to deliver immediate benefits. Interventions promised in the recovery plan will take time to cascade through complex economic sectors, agencies and diverse markets before the jobless at the bottom of the socioeconomic pyramid experience any life improvements. Meanwhile the global COVID-19 pandemic is pulling leading economies into a slump worse than the Great Recession of 2007–2009. Peter Jacobs, Pelontle Lekomanyane and Karabo Nyezi contextualise South Africa’s jobs-growth crises.

South Africa (SA)’s economic downturn began before the COVID-19-related recession started engulfing the world economy. Given the severity of the current recession, SA will not escape domestic socioeconomic turmoil, like any other middle-income economy heavily dependent on exporting natural resources. Early forecasts suggest that the domestic macroeconomic crisis will be longer and deeper than predictions made in the February 2020 budget. The combined health and economic crises in an unequal society will aggravate the depressed living standards of many.

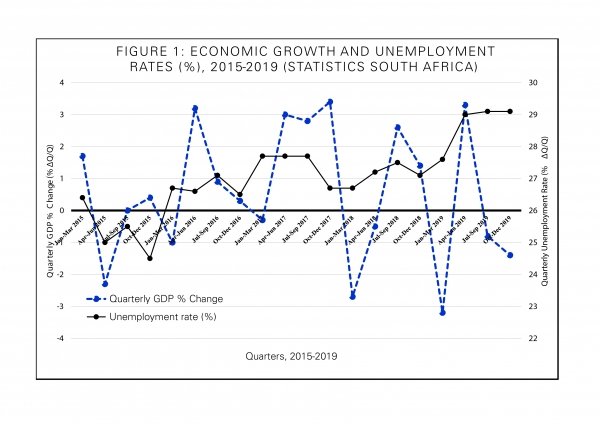

The 2019 downturn repeated a well-known pattern: when economic output shrinks, it triggers an expansion in unemployment. With rare exceptions, this inverse relationship characterises the typical boom and bust cycles of economies. Figure 1 confirms the case in SA, at least for 2019. Monthly and quarterly fluctuations in output appear erratic and without a clear trend for 2015–2019, as the dotted blue line shows. These fluctuations might reflect statistical ‘noise’ intrinsic to short-term data, but also point to quarterly macroeconomic instabilities with heightened risks and uncertainties that often ignite spinoff economic shocks.

In contrast, the jobless rate has steadily climbed to above 26% and worsened significantly since the last quarter of 2018. By the end of 2019, the unemployment rate registered a two percentage-points increase compared to 2018, with no prospect of any quick reversal. COVID-19-related restrictions on physical movement and non-essential economic activities worsened the economic slump. If macroeconomic policy targets job creation in the South African context, it must look beyond recovery plans to stabilise economic growth in the short term. It calls for macroeconomic interventions prioritising equitable restructuring of the economy.

SA’s unemployment-recession puzzle in context

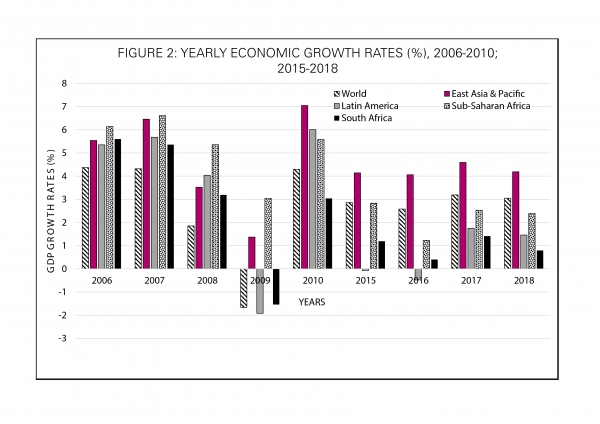

Is SA’s economic growth-unemployment puzzle, coupled with the macroeconomic interventions demanded in recessions, exceptional? This question is particularly important for detailing evidence-informed policies that stand to be enriched through learning from policy experiences accumulated during past recessionary cycles. Figure 2 shows that from 2006 to 2018 average yearly rates of global economic growth fluctuated between 1.85% and 4.37% during ‘moments of prosperity’. However, economic growth is uneven across regions and countries, with Sub-Saharan Africa and East Asia & Pacific outperforming Latin America. This unevenness is unsurprising, and primarily reflects widespread variations in the sectoral composition of economic activity, productivity differences and how developed or underdeveloped economies remain — even if every national economy has been globalised through international trade, capital flows and labour migration.

A synchronised downturn in economic growth began after 2007, marking the onset of the Great Recession. Even though the speed of the economic downturn varied across regions and countries, the magnitude of the decline was so severe that the average world growth rate moved into negative territory. By 2009, as Figure 2 illustrates, SA and major economies in Latin America, as well as the United States and many European economies, had fallen into deep recession.

It is puzzling why SA’s unstable and fragile growth pattern matches trends in Latin American economies rather than experiences among its Sub-Saharan neighbours. Also, while SA bounced back to positive growth in 2010 (with the rest of the world), the country’s growth rate hovered around 1% post-2010, on the cliff-edge of sliding into a new recession. Commentators agonised about the uneven recoveries, with almost every macroeconomic model forecasting a double-dip recession on the horizon. Even though only Latin America fell into recession in 2015 and 2016, SA and many developed economies failed to escape increasing vulnerability to another economic shock.

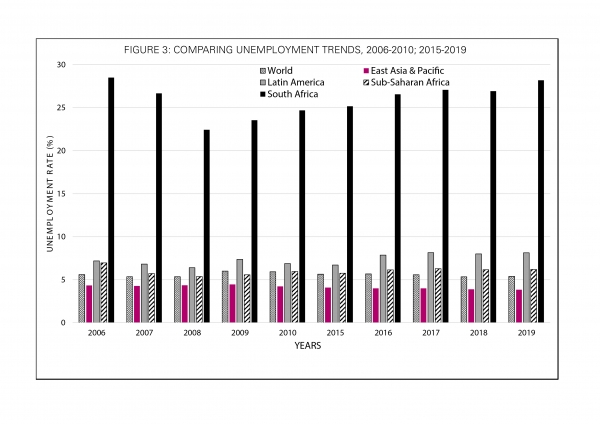

Comparing SA’s unemployment trend with the global average and other regions is revealing in itself, with key insights into the growth-jobs (or recession-unemployment) puzzle. Figure 3 places SA’s case in comparative context. The average global rate of unemployment fluctuated in the 5%–6% range from 2006 to 2019. While the average unemployment rate for East Asia & Pacific remained below the lower boundary of the global range, Latin America and Sub-Saharan Africa recorded rates above the upper boundary of the worldwide average. This regional comparison suggests that the rise in average unemployment rates due to shrinking economic output in the Great Recession was confined to a few countries and regions, especially Latin America.

Figure 3 depicts the unemployment rate in SA as an outlier, given its extraordinarily high level. The overall trend of SA’s unemployment rate matches patterns observable in some countries in Latin America. However, this commonality is eclectic and merits in-depth investigation. This descriptive overview does not explain why SA’s unemployment rate is more than double the average for Latin America, and what this means for macroeconomic restructuring. Beyond the high unemployment rate, the protracted nature of this crisis has not been resolved and deserves scrutiny. Without a thorough assessment of why this unemployment crisis has endured for more than 25 years despite copious macroeconomic reforms, urgent restructuring to transition out of the COVID-19 depression will not be produced.

Finding lasting solutions to SA’s jobs-growth puzzle has become more pressing. Economic growth might be necessary for job creation, but it has not been sufficient to solve SA’s unemployment crisis.

In the aftermath of the COVID-19 pandemic, prevention of an additional decline in aggregate employment and turning this around is high on the agenda of SA’s policymakers. The unequal effects of COVID-19 on employment in different sectors calls for a disaggregated framework of employment generation.

Tough questions must also be answered about the composition of forces driving economic output and how these factors interactively translate into sustainable jobs. This debate also pivots on whether employment is a function of economic output, or economic output is a function of labour input. To avoid a circular reasoning trap, the mechanics at work in these chain reactions must be dissected, coupled with looking at why a shift in the outcome variable might lag behind change in the input variable.

The COVID-19 pandemic has curbed economic activities through multiple mechanisms and brought certain sectors of the economy to a standstill, tilting the economic recession into a depression.

An important question is how the South African government can mediate to stimulate the economy and counter the economic effects of the pandemic. When thinking about policies to stimulate the economy while also recognising public-health restrictions that constrain some sectors more than others, it is useful to think about sectors that could overcome the trade-offs between resolving the health crisis and the lasting unemployment crisis.

Authors: Dr Peter Jacobs, acting strategic lead, Pelontle Lekomanyane, researcher, and Karabo Nyezi, research assistant in the HSRC’s Inclusive Economic Development division

pjacobs@hsrc.ac.za